Turbotax S Corp Business For Mac 2017

S-corps do not pay taxes. The income is passed thru to the shareholders on a K-1 and they pay taxes on their personal returns. So to compute & produce 2018 estimated payments you will use one of the 2017 personal income tax products NOT the TT Business version. Login to your MyTurboTax account to start, continue, or amend a tax return, get a copy of a past tax return, or check the e-file and tax refund status.

• The tax reform consulting promotion is a free offer subject to cancellation at any time without notice. The promotion is limited to one 15min consultation per person with a tax expert. The consult will be solely for the purpose of explaining the impacts of tax reform, the tax expert will not give advice or tax prep guidance on prior year taxes. • TURBOTAX GUARANTEES • 100% Accurate Calculations Guarantee: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. • Maximum Refund Guarantee - or Your Money Back: If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the applicable TurboTax federal and/or state purchase price paid. TurboTax Online Free Edition customers are entitled to payment of $14.99 and a refund of your state purchase price paid. • 100% Accurate, Expert Approved Guarantee: If you pay an IRS or state penalty (or interest) because of an error that a TurboTax CPA or EA made while signing your return, we’ll pay you the penalty and interest.

This tax form is for informational purposes only and provides the IRS with an aggregate view of the business’ earnings and expenses. Along with the Form 1120S, the S corporation is also responsible for preparing a separate K-1 for each shareholder to report their respective share of earnings and deductions on their own tax returns. To illustrate, suppose your S corporation has 10 equal shareholders and earns $1 million in revenue and reports $500,000 in deductible expenses. In most cases, the S corporation must attach 10 K-1s to the Form 1120S, each of which should report $100,000 in revenue and $50,000 in expenses to each shareholder. All of these forms are due to the IRS by the 15th day of the third month following the close of the tax year, which is usually March 15.

• Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. • Pay for TurboTax out of your federal refund: A $X.XX Refund Processing Service fee applies to this payment method.

• Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. • Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. • TurboTax Live Reviews: Displayed reviews are for the TurboTax Live standalone service from Tax Year 2017 and not for the new Turbo Tax product / TurboTax Live bundle available for Tax Year 2018. • Pay for TurboTax out of your federal refund: A $X.XX Refund Processing Service fee applies to this payment method. Prices are subject to change without notice. • TurboTax Help and Support: Access to a TurboTax specialist is included with TurboTax Deluxe, Premier, Self-Employed and TurboTax Live; not included with Free Edition (but is available as an upgrade).

Break information down into a numbered or bulleted list and highlight the most important details in bold. • Be concise. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines.

Prices are subject to change without notice. This benefit is available with TurboTax Federal products except TurboTax Business. • About our TurboTax Product Experts: Customer service and product support vary by time of year.

• Maximize your IRA savings Retirement tax help and IRA tool show you how to get more money back this year and when you retire. • See your best rental depreciation method Simplify reporting your rental property depreciation. We'll show you which depreciation method will get you the biggest tax deduction. • Refinancing deductions Save every penny—we’ll guide you through deducting points, appraisal fees, and more from your refinance. • Guidance and support with new rental properties We’ll guide you on how to set up new. Plus, our median monthly rent calculator can help you find the fair market value for your rental property. • Find every tax deduction and credit you qualify for We'll get to know you by asking simple questions about your income, family and changes in your tax situation.

We’ll also amend your return at no additional cost. • Audit Support Guarantee: If you received an audit letter based on your 2017 TurboTax return and are not satisfied with how we responded to your inquiry, we’ll refund the applicable TurboTax federal 1040 and/or state purchase price you paid. TurboTax Free Edition customers are entitled to payment of $14.99 and a refund of your state purchase price paid. We will not represent you or provide legal advice. Excludes TurboTax Business.

Additional fees apply for e-filing state returns. E-file fees do not apply to New York state returns. Savings and price comparison based on anticipated price increase. Prices subject to change without notice. • Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. • Pay for TurboTax out of your federal refund: A $X.XX Refund Processing Service fee applies to this payment method.

TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve. Note:We will send the download file via Email after payment successfully.

Microsoft Office Mac 2011 Product Key. Product Key Generator Crack + Keygen Free Download di blog Free Download Software jika anda ingin menyebar-luaskan.

Microsoft Office Mac 2011 Product Key. Product Key Generator Crack + Keygen Free Download di blog Free Download Software jika anda ingin menyebar-luaskan.

People come to TurboTax AnswerXchange for help and answers—we want to let them know that we're here to listen and share our knowledge. We do that with the style and format of our responses. Here are five guidelines: • Keep it conversational.

• Prepare tax returns for multiple businesses Prepare income tax returns for multiple businesses, even if they are different entity types. • Guidance for real estate rental property activities Get step-by-step guidance through a customized rental real estate experience, so you can be sure that all related income and expenses are covered. • Free e-file: Get your fastest possible tax refund * E-file your federal and state tax return with direct deposit to get your fastest tax refund possible. • Transfer your federal tax info to state and finish up fast Once you complete your federal taxes, we can transfer your information over to your state return to help you finish quickly and easily. Additional fees apply. Windows ® CD/Download Products Below are the minimum requirements for TurboTax Federal 2018 software installed on a Windows computer. Processor • Pentium 4 or later/Athlon or later.

• #1 best-selling tax software: Based on aggregated sales data for all tax year 2017 TurboTax products. • Data Import: Imports financial data from participating companies; may require a free Intuit online account. Quicken and QuickBooks import not available with TurboTax installed on a Mac. Imports from Quicken (2016 and higher) and QuickBooks Desktop (2014 and higher); both Windows only.

Latest TurboTax Premier 2018 Tax Software For MAC TurboTax Premier is recommended if you sold stocks, bonds, mutual funds or options for an employee stock purchase plan, own rental property or you are the beneficiary of an estate or trust (received a K-1 form). TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund. TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve. Up-to-date with the latest tax laws-so you can be confident your taxes will be done right. Note:We will send the download file via Email after payment successfully. TurboTax Home & Business 2018 Tax Software Online Download For MAC TurboTax 2018 Home & Business is recommended if you received income from a side job or are self-employed, an independent contractor, freelancer, consultant or sole proprietor, you prepare W-2 and 1099 MISC forms for employees or contractors, you file your personal and self-employed tax together (if you own an S Corp, C Corp, Partnership or multiple-owner LLC, choose TurboTax Business).

Hard Disk Space • 650 MB for TurboTax (plus up to 4.5 GB for Microsoft.NET 4.5.2 client if not already installed). Third Party Software • Microsoft.NET 4.5.2 included with TurboTax Installer.

TurboTax Home & Business 2018 Tax Software Online Download For MAC TurboTax 2018 Home & Business is recommended if you received income from a side job or are self-employed, an independent contractor, freelancer, consultant or sole proprietor, you prepare W-2 and 1099 MISC forms for employees or contractors, you file your personal and self-employed tax together (if you own an S Corp, C Corp, Partnership or multiple-owner LLC, choose TurboTax Business). TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund. TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve.

TurboTax Download • Free Federal Efile Included — Free efile of your federal tax return is included with your purchase of TurboTax Download. • Efile Multiple Returns — Prepare and efile up to five (5) federal tax returns at no additional cost. (This is the maximum returns limit set by the IRS.) • or Print and Mail Your Return(s) — Print as many copies of your federal returns as you need for free when you purchase TurboTax Download. • State filing is an additional cost with this version of Turbotax. TurboTax Business takes the worry out of deciding which forms you need to file.

Install Turbotax 2017 On Mac

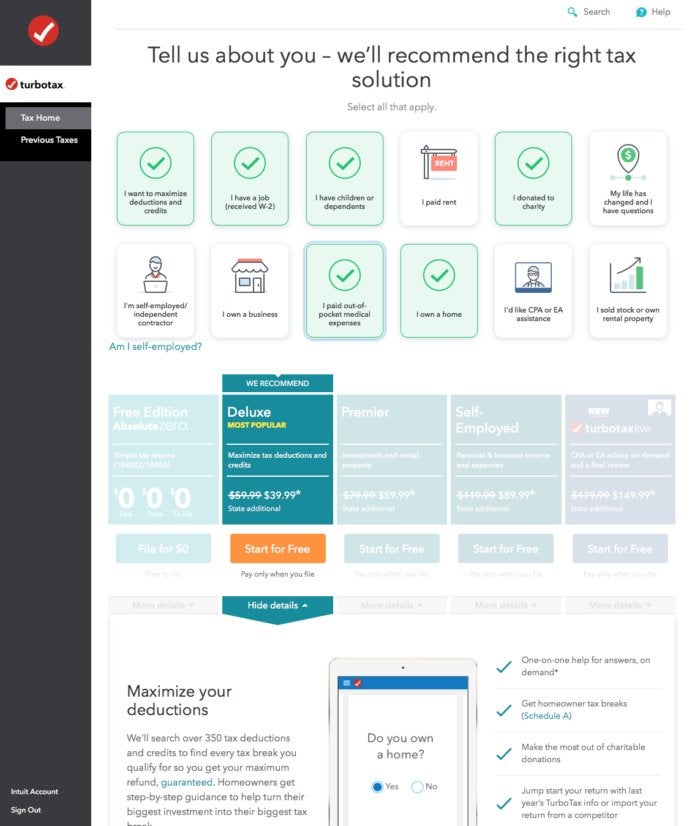

• #1 best-selling tax software: Based on aggregated sales data for all tax year 2016 TurboTax products. • Most Popular: TurboTax Deluxe is our most popular product among TurboTax Online users with more complex tax situations. • CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund. • #1 rated online tax prep provider: Based on independent comparison of the by March 13, 2017. • Get tips based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent.

Ask yourself what specific information the person really needs and then provide it. Stick to the topic and avoid unnecessary details. Break information down into a numbered or bulleted list and highlight the most important details in bold. • Be concise. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines. A wall of text can look intimidating and many won't read it, so break it up.

Just answer simple questions and TurboTax Business fills out the right forms for you. Windows Download Products Below are the minimum requirements for TurboTax Federal 2016 software installed on a Windows computer. Processor • Pentium 4 or Later. • Athlon or Later.

Turbotax 2017 PC Download THIS IS A DOWNLOAD - NO DISC WILL BE SHIPPED THIS PRODUCT IS FOR WINDOWS/PC ONLY THIS VERSION IS NOT AVAILABLE FOR MAC This is the latest version of Turbotax for filing your 2017 taxes in 2018. Partnerships, S Corp, C Corp, multi-member LLC, trusts and estates • Prepare and file your business or trust taxes with confidence • Get guidance in reporting income and expenses • Boost your bottom line with industry-specific tax deductions • Take care of partnership, S Corp, C Corp, multi-member LLC or trust forms. Everything You Need to Easily Do Your Business Taxes Customized interview tailors itself to your type of business (corporation, partnership, or multi-member LLC) Extra guidance for new businesses—TurboTax will show you the startup tax deductions for new businesses so you can get the maximum refund you deserve Create and distribute K-1 Forms electronically in PDF format and save a trip to the post office Easy transfer of your Federal Return to Your State Return* (State Return sold separately via easy download).

TurboTax Deluxe 2018 is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund. TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve. Note:We will send the download file via Email after payment successfully. Latest TurboTax Premier 2018 Tax Software For MAC TurboTax Premier is recommended if you sold stocks, bonds, mutual funds or options for an employee stock purchase plan, own rental property or you are the beneficiary of an estate or trust (received a K-1 form). TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund. TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve. Up-to-date with the latest tax laws-so you can be confident your taxes will be done right.

• Always up-to-date When, we’re on top of it, so you can be sure your tax return includes the latest IRS and state tax forms. • Your information is secure We're dedicated to safeguarding your personal information. We test our site daily for security, use the most advanced technology available, and employ a dedicated Privacy Team. • See your tax refund in real time We display and update your federal and state tax refunds (or taxes due) as you do your income taxes, so you always know where you stand.

Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. • Tax Advice, Expert Review and TurboTax Live: Access to tax advice and Expert Review (the ability to have a Tax Expert review and/or sign your tax return) is included with TurboTax Live or as an upgrade from another version, and available through October 15, 2018. These services are provided only by credentialed CPAs, EAs or tax attorneys. State tax advice is free.

Turbotax 2017 Download Mac

Monitor • 1024x768 or higher recommended. Operating Systems • Windows Vista (Service Pack 2 or latest) • Windows 7 (Service Pack 1 or latest) • Windows 8 • Windows 8.1 • Windows 10 • Administrative rights required. RAM • 1 GB or more recommended. Hard Disk Space • 650 MB for TurboTax (plus up to 4.5 GB for Microsoft.NET 4.5.2 client if not already installed). Third Party Software • Microsoft.NET 4.5.2 included with TurboTax Installer. • Adobe Reader 11 or higher.

Internet Connection • 56 Kbps (Broadband connection highly recommended). Printer • Any Macintosh-compatible inkjet or laser printer. ------------------------------------------------------------- Learn More: digital download- no cd will be shipped.

• Perfect for independent contractors (1099) If you’re an independent contractor or do freelance work you may get to deduct expenses like travel and entertainment to lighten that tax bill. That’s where we come in, searching over 350 deductions and credits so you don’t miss a thing. Minimum requirements for your computer Windows ® CD/Download Products Below are the minimum requirements for TurboTax Deluxe Federal software installed on a Windows computer. Processor • Pentium 4 or Later. • Athlon or Later. Monitor • 1024x768 or higher recommended. Operating Systems • Windows Vista • Windows 7 • Windows 8 • Windows 8.1 • Windows 10 • Administrative rights required.

• Everything in Premier plus extra guidance for self-employment & business deductions • Easily import business data and expenses-Save time and help ensure accuracy by easily importing your QuickBooks and Quicken data* • Generate W-2 and 1099 forms fast-Quickly prepare ready-to-print forms for contractors and employees • Extra guidance for new business start-ups-TurboTax walks you through start-up costs that your business can deduct • Includes 5 free federal e-files and one download of a TurboTax state product Note:We will send the download file via Email after payment successfully. Latest TurboTax Deluxe 2018 Tax Software Online Download For Windows or MAC TurboTax Deluxe 2018 is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child-related expenses or have a lot of deductions. TurboTax Deluxe 2018 is tailored to your unique situation-it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund. TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you’re getting every dollar you deserve. Note:We will send the download file via Email after payment successfully. SKU: TurboTax Deluxe 2018.